Pulished on Feb. 04, 2025

As we approach 2025, the global demand for high-quality cutlery sets continues to rise, with China maintaining its position as a major exporter of cutlery products. Known for its robust manufacturing industry, China’s cutlery exports have experienced steady growth over the years, fueled by innovations in design, an expanding middle class worldwide, and the ever-growing demand for premium kitchenware.

China has become a global leader in the manufacturing of cutlery sets, which include knives, forks, spoons, and other dining utensils. These products are available in various materials such as stainless steel, ceramic, and plastic, each catering to different market segments.According to data from the China Chamber of Commerce for Import and Export of Light Industrial Products and Arts-Crafts, the production of cutlery in China in 2024 reached approximately $5.5 billion USD, with forecasts indicating a 5% growth in 2025. This growth is driven by both domestic demand and the increasing volume of exports to global markets.

In 2024, China exported over $4 billion USD worth of cutlery products, a significant portion of which went to major markets like the United States, Europe, and emerging economies in Asia and the Middle East. The U.S. remains China’s largest trading partner for cutlery products, with over 20% of total cutlery exports heading to North America. European countries like Germany, the U.K., and France also remain important markets, accounting for around 15% of exports. The Middle East and South Asia have seen a surge in demand, driven by rising disposable incomes and a growing middle class, contributing to a 10% increase in exports to these regions.

China's cutlery exporters face competition from other manufacturing hubs, such as India and Vietnam, but continue to hold a dominant position due to their economies of scale, low labor costs, and the ability to meet diverse consumer demands. The country also benefits from well-established trade networks, including participation in the Belt and Road Initiative (BRI), which has further strengthened its export infrastructure.

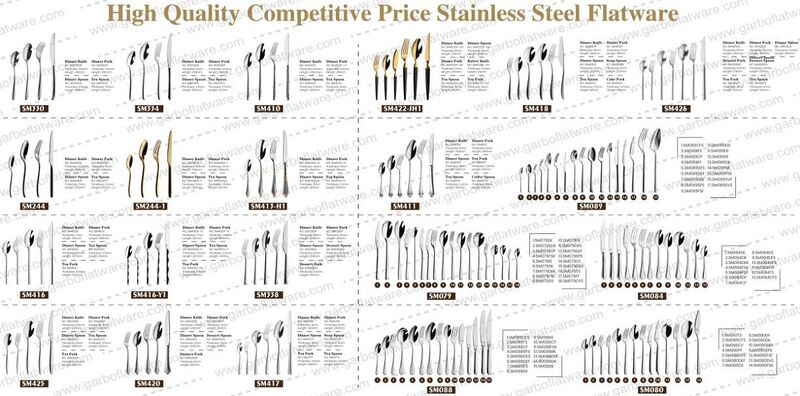

The global consumer market for cutlery sets is becoming increasingly diverse. A growing interest in premium cutlery, often made of high-quality stainless steel, ceramic, and eco-friendly materials, is driving demand for China’s higher-end products. Eco-consciousness is a key factor in shaping consumer preferences, with a marked increase in demand for sustainable, recyclable, and biodegradable options, such as bamboo and recycled stainless steel utensils.

In 2025, China's manufacturers are expected to invest more in research and development (R&D) to innovate in areas such as ergonomic designs, multifunctional utensils, and incorporating technology into cutlery products (e.g., knives with built-in sharpening systems or forks with sensors to measure portion size).

Additionally, there is a growing demand for custom-designed cutlery sets, with many consumers seeking unique, personalized products for special occasions, such as weddings or luxury dining experiences. Chinese manufacturers have been quick to meet this demand, offering customizable engravings, varied finishes, and innovative packaging designs.

The Chinese cutlery industry faces several challenges heading into 2025:

Supply Chain Disruptions: As the global economy continues to recover from the disruptions caused by the COVID-19 pandemic, China’s cutlery exporters must navigate global supply chain challenges, including fluctuating raw material costs and shipping delays. This has led some manufacturers to diversify their supply chains to ensure consistency in product delivery.

Rising Raw Material Costs: Stainless steel, a key component in the production of high-quality cutlery, has seen price increases due to global demand and supply chain constraints. These price hikes could impact manufacturers’ profit margins if they are unable to pass costs on to consumers.

Regulatory Standards: Exporters must comply with international standards and certifications, such as FDA and EU regulations, particularly in markets like North America and Europe. This may require additional investments in quality control and compliance testing.

Despite these challenges, opportunities abound for Chinese exporters in the cutlery market. The trend toward premium, eco-friendly, and customizable products presents significant growth potential. Additionally, as online retailing continues to expand, Chinese manufacturers have the opportunity to tap into the e-commerce boom, reaching consumers in untapped markets and selling directly to end-users.

China remains a dominant force in the global cutlery export market as it approaches 2025, with continued growth in production and exports. With a focus on innovation, sustainability, and adapting to evolving consumer preferences, Chinese manufacturers are well-positioned to capitalize on the rising demand for high-quality cutlery sets. By addressing challenges such as supply chain disruptions and rising raw material costs, China’s cutlery industry can maintain its leadership role and further strengthen its export prospects in the years to come.

Looking for Flatware Supplier?

OEM&ODM RequestRequest for Quotation?

Get Factory PriceAny Confusion?

Speak With SalesmanWe deliver the quality and value your flatware needs, on time and within budget.

Contact UsODM&OEM Service

Our flatware is certified by leading retailers including Walmart, Tesco, Costco, Lidl, Target, and METRO, ensuring the highest quality standards.

Experience seamless service from design to export with our one-stop solutions. Our team simplifying your export process and allowing you to focus on growing your business.

Choose from a range of eco-friendly and customized packaging options to suit your specific needs. Our packaging solutions are designed to protect your products while reducing environmental impact.

Our efficient supply chain ensures timely delivery of your custom cutlery, minimizing lead times and keeping your business operations running smoothly.

Comprehensive support & satisfaction guaranteed.